2024 Cook County Tax Appeal: How do I know if my property taxes are going up?

You may have heard from a neighbor, seen a flyer, gotten a black and white notice with a small photo of your house from the Cook County Assessor's Office (CCAO) and heard something about property taxes. And possibly someone on Facebook or in person may have mentioned you should appeal. This can certainly be confusing if you never received a notice or misplaced it, so here's a quick guide to help you find out if your property is valued higher than previous years, which ultimately raises your property taxes.

Find Your PIN: Property Index Number

Why do you need your PIN? It makes everything easier in case you need to look up any information, and you will need this if you decide to file using a paper form.

1. You can find your property PIN on any of your Cook County tax records, your sale papers, or the sheet from the CCAO that was mailed out about a month before your deadline to appeal (November 13, 2024).

2. You can also search for your PIN on many city websites, but the CCAO allows you to search by your address and find your PIN. They even have a handy video that walks you through this on their website:

Finding your PIN: Property Index Number online

Once you find your PIN, you are ready to look up your property value and determine if you would like to appeal. If you still can't find your PIN, you can also go to Search > Property > Property Search by Address.

Your New Assessed Value

Paper Assessment: If you have your recent property assessment from the CCAO, the black and white one-sheeter that has a photo of your house, it should show you assessed market value for the current year, and two years prior. More than likely, these value columns have gone up, which means you should appeal.

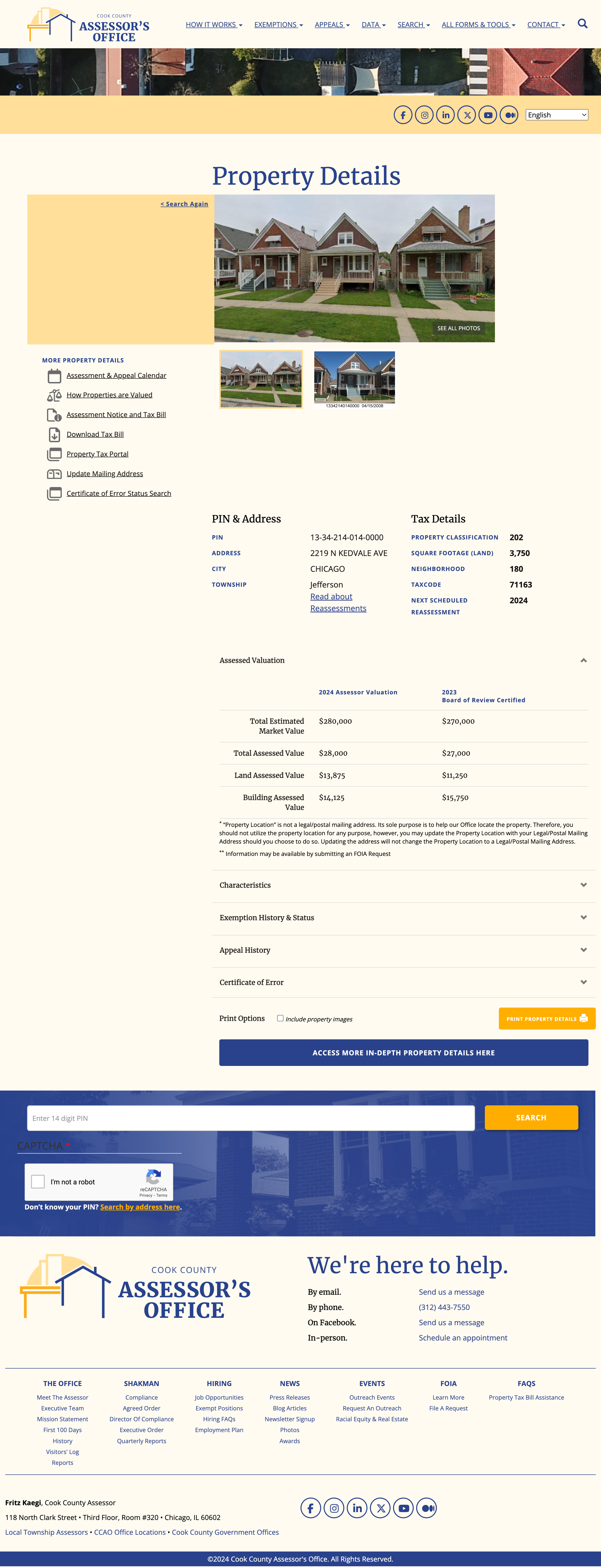

Online Assessment: If you do not have a paper form and you've gotten your PIN, go to the http://www.cookcountyassessor.com and navigate to Search > Property > Property Search by PIN. Once you enter your PIN and the random security code to make sure you are not a robot and submit the form, you will see all your personal data and property information. You will see your new 2024 assessed value.

Yes, any of your neighbors can look up your Property Value, and vice versa. You can also see if they have appealed!

REVIEW YOUR 2024 MARKET VALUE

REVIEW PROPERTY DETAILS

You should review all “characteristics” about your home/property to make sure it is correct.

Number of stories

Single or multifamily residence

Number of Full and Half Baths

Basement and Attic: Full or None? Unfinished or Finished?

Central air?

Number of fireplaces?

Garage type?: 1? 2? Attached or Detached?

Age

Square Footage

If there are any errors, you will need to have them corrected. Be aware that depending on the correction, it may affect your assessment (lower or higher). Example: if your building square footage of living space has increased in your home (say, over 1000 ft), but your assessment shows less than 1000 feet, that may not work in your favor. In other cases it may show more square footage than you actually have, which would be a benefit. It is up to you to have it corrected.

3. REVIEW PROPERTY MARKET VALUE AND ASSESSMENT HISTORY

4. REVIEW YOUR EXEMPTIONS

Most people who live in their homes qualify for the “Homeowners Exemption.” They auto-renew each year if you are already seeing this exemption. If you own property you rent out but don’t live there, you would not qualify. Other types of exemptions:

Senior exemption (auto-renews)

Senior Freeze

Long Time

Returning Veteran

Person with Disabilities (auto-renews until 2027)

Veterans with Disabilities

For more information on qualifications and exemptions, go to the Cook County Assessors website.